The Definitive Guide for Pvm Accounting

The Definitive Guide for Pvm Accounting

Blog Article

Getting My Pvm Accounting To Work

Table of ContentsPvm Accounting Fundamentals ExplainedThe Best Strategy To Use For Pvm AccountingThe Definitive Guide to Pvm AccountingLittle Known Facts About Pvm Accounting.Some Known Factual Statements About Pvm Accounting Little Known Facts About Pvm Accounting.

Make certain that the accountancy procedure complies with the law. Apply needed building and construction accountancy requirements and procedures to the recording and reporting of construction task.Interact with numerous funding agencies (i.e. Title Business, Escrow Business) concerning the pay application process and requirements required for repayment. Aid with executing and maintaining internal financial controls and procedures.

The above declarations are planned to define the general nature and degree of job being executed by people designated to this classification. They are not to be taken as an extensive listing of duties, tasks, and abilities required. Employees might be needed to do tasks beyond their normal duties once in a while, as required.

Not known Facts About Pvm Accounting

You will aid sustain the Accel team to ensure shipment of effective in a timely manner, on spending plan, tasks. Accel is seeking a Construction Accountant for the Chicago Workplace. The Construction Accountant executes a variety of bookkeeping, insurance coverage conformity, and project management. Works both separately and within specific departments to keep monetary documents and make sure that all records are maintained present.

Principal responsibilities include, yet are not restricted to, handling all accounting functions of the company in a timely and accurate fashion and offering records and schedules to the firm's CPA Firm in the prep work of all economic statements. Makes sure that all audit procedures and features are taken care of precisely. In charge of all monetary records, pay-roll, banking and daily operation of the bookkeeping function.

Prepares bi-weekly trial equilibrium records. Works with Task Supervisors to prepare and publish all monthly billings. Processes and concerns all accounts payable and subcontractor repayments. Generates month-to-month recaps for Employees Settlement and General Obligation insurance coverage premiums. Produces monthly Task Cost to Date records and working with PMs to integrate with Job Managers' allocate each job.

Pvm Accounting Can Be Fun For Everyone

Effectiveness in Sage 300 Building and Property (formerly Sage Timberline Workplace) and Procore construction management software program an and also. https://yoomark.com/content/pvm-accounting-full-service-construction-accounting-firm-if-you-spend-too-much-time. Must also excel in other computer software program systems for the prep work of reports, spread sheets and other accountancy analysis that may be needed by monitoring. financial reports. Should possess strong organizational skills and ability to prioritize

They are the financial custodians that make sure that construction projects stay on budget, abide by tax obligation policies, and maintain economic transparency. Construction accounting professionals are not simply number crunchers; they are tactical companions in the building process. Their key duty is to handle the financial facets of construction projects, ensuring that sources are designated efficiently and financial dangers are reduced.

Not known Factual Statements About Pvm Accounting

They work closely with project supervisors to develop and check spending plans, track costs, and forecast economic demands. By maintaining a tight hold on project financial resources, accountants aid stop overspending and financial setbacks. Budgeting is a keystone of successful building and construction jobs, and construction accounting professionals contribute in this respect. They create thorough budget plans that encompass all job expenditures, from products and labor to permits and insurance policy.

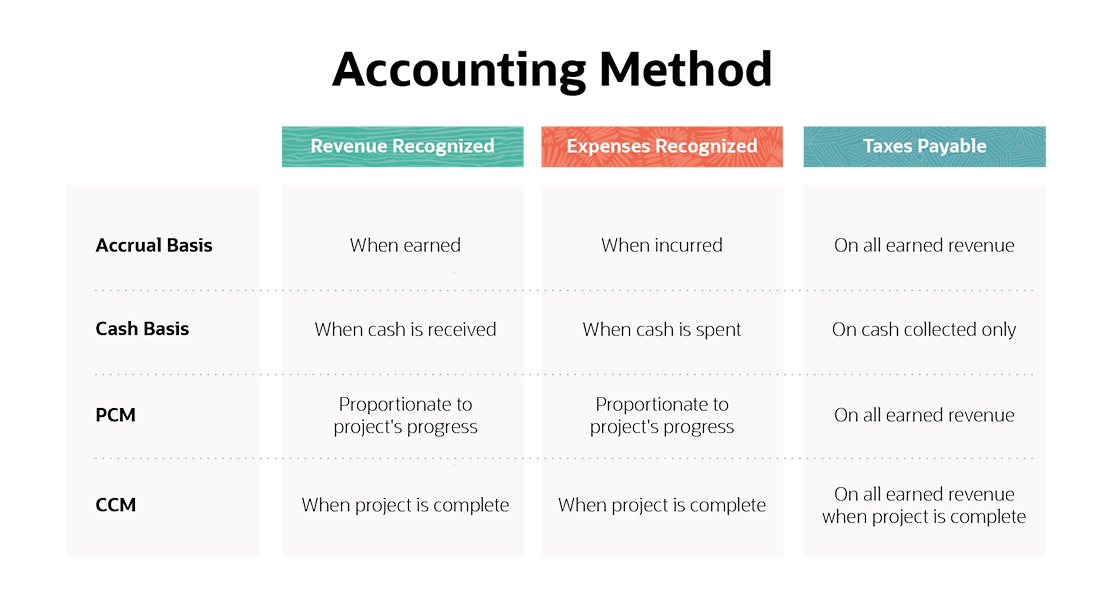

Navigating the complex web of tax guidelines in the building and construction industry can be challenging. Construction accountants are skilled in these policies and make certain that the project abides with all tax needs. This consists of handling pay-roll taxes, sales taxes, and any kind of various other tax obligation responsibilities specific to construction. To excel in the role of a building accountant, individuals require a strong academic structure in audit and money.

Additionally, accreditations such as Qualified Public Accountant (CERTIFIED PUBLIC ACCOUNTANT) or Certified Building Sector Financial Specialist (CCIFP) are very concerned in the market. Building and construction tasks usually involve tight due dates, altering guidelines, and unforeseen expenditures.

Pvm Accounting for Dummies

Ans: Building accountants create and monitor spending plans, identifying cost-saving opportunities and making sure that the job remains within budget plan. Ans: Yes, construction accounting professionals handle tax obligation compliance for construction tasks.

Introduction to Building And Construction Bookkeeping By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building and construction business need to make challenging selections amongst many monetary choices, like bidding on one task over another, choosing funding for materials or devices, or setting a project's earnings margin. On top of that, building and construction is a notoriously unpredictable market with a high failing rate, slow-moving time to repayment, and irregular cash flow.

Production includes duplicated processes with conveniently recognizable costs. Manufacturing requires different processes, products, and equipment with differing expenses. Each job takes location in a new area with differing site conditions and special difficulties.

The Facts About Pvm Accounting Revealed

Frequent use of different specialized professionals and distributors impacts effectiveness and cash circulation. Settlement gets here in full or with normal repayments for the complete agreement quantity. Some portion of payment may be kept till task completion also when the service provider's work is finished.

While conventional makers have the advantage of regulated atmospheres and enhanced manufacturing processes, building and construction business must regularly adapt to each brand-new task. Even rather repeatable jobs need why not look here modifications due to website conditions and various other variables.

Report this page